About Home Improvement Financing

Table of ContentsSome Ideas on Home Improvement Financing You Need To KnowHome Improvement Financing Fundamentals Explained

Putting expensive home enhancement and also repair work prices on a bank card is certainly not the most effective selection if you know it will definitely take you several months or years to pay for those completely. Pros Could be unsecured (no danger of dropping your home)Relying on the finance company and your credit history, enthusiasm rates could be more than house equity car loans Quick as well as easy document procedure; quick accessibility to funds, No income tax reduction advantages Typically no prepayment fines & may possess better APRs than normal charge card May feature an origination charge (this is normally less than closing expenses on a residence equity financing or even credit line) To find the greatest residence enhancement funding, it pays to search - home improvement financing.It relies on your monetary circumstance as well as the sort of home repair you desire to perform. If you choose certainly not to use your residential or commercial property as collateral, unsafe individual finances might be the absolute best form of car loan for pricey residence enhancements or even big restoration ventures. As opposed helpful hints to a lengthy underwriting procedure (common along with home equity finances), the financial institution will this article certainly check out your credit history and credit rating, your profit, and any kind of current debt to find out the funding provide.

You'll after that create month-to-month payments with the lifestyle of your financing. Home remodeling fundings might be actually tax deductible if those loans are protected through the property, but you need to speak with a professional income tax specialist before getting your funding and also prior to filing your tax obligations. A residence equity funding may be the best way to acquire amount of money for residence improvements along with below par credit history.

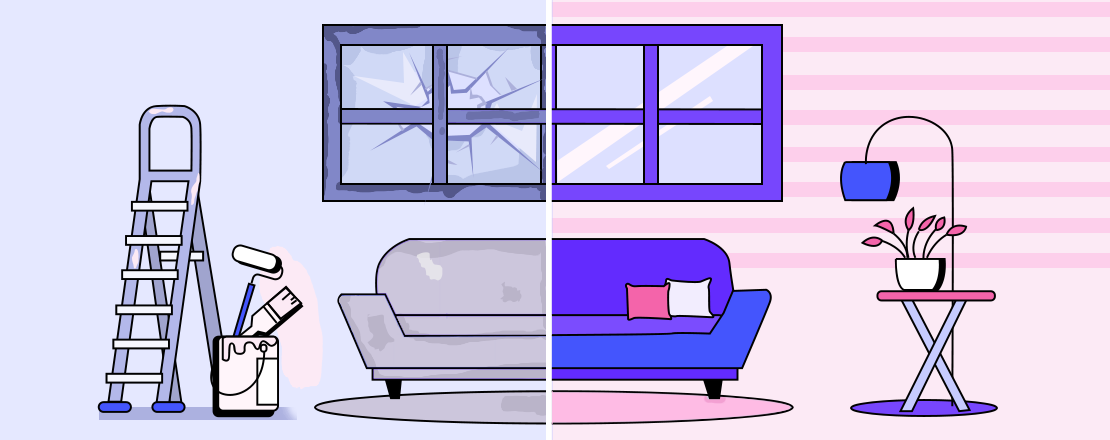

Locate the ideal property enhancement loan to make your dream residence, As a property owner, you have actually very likely experienced an unforeseen concern that was costly to repair - home improvement financing. Or perhaps you have actually thought why not find out more regarding hiring a neighborhood property remodeling professional to redesign your kitchen but made a decision versus it as a result of the high price.

The 4-Minute Rule for Home Improvement Financing